|

|

blog roll

|

we have comments...,

2003-10-24 17:03:54

| Main |

cooperating in the war on terror...,

2003-10-27 13:48:11

free trade:

means always being able to replace an illegal export subsidy with an even bigger legal one:

The total cost of the [corporate tax cut] bill to the Treasury would be less than $60 billion, since the cost of the tax cuts would be offset by the repeal of existing export subsidies

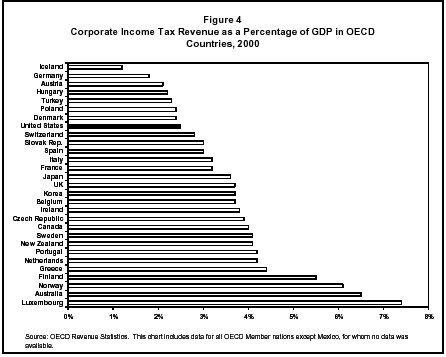

The article suggests that the US "is now among the highest [corporate] tax countries in the industrial world" but it doesn't seem to mean much in real terms as "over the past three years, corporate tax revenues have plunged 36 percent and now represent just 7.4 percent of the federal government's total tax take" - largely due to tax shelters. Taking corporate tax revenue as percentage of GDP one finds that, among industrialized nations, the US has among the lowest actual tax burdens for corporate entities:

[Center on Budget and Policy Priorities]

Links via Sawicky. If I were an anti-government free-trade zealot I'd be ecstatic, but instead I'm an anti-government fair-trade reform zealot who supports a massive re-allocation of society's resources towards sustainable development over an ideologically justified system of resource exploitation and waste that is mistakenly called "product", so I get cranky when trade is skewed further (because any given third world country under the thumb of IMF structural adjustment programs wouldn't be allowed such massive trade subsidies in the first place) and the term "abusive" gets thrown around liberally by the IRS when discussing tax evasion by our primary economic institutions:

GAO cited a database maintained by the IRS

that shows that through 2003 about $85 billion in revenues have been lost as a result of known

tax shelters (used by businesses and wealthy individuals) that IRS has officially classified as

abusive or that have characteristics of abusive transactions. These revenue losses date back to

1989, but the majority occurred in years after 1993. Another analysis, which was conducted by a

contractor at the request of the IRS, concluded that the revenue losses from corporate tax shelters

alone were even higher, estimating an average annual loss of between $11.6 billion and $15.1

billion for the period 1993 through 1999. The estimates also show that the size of the abusive

shelter problem grew in each year analyzed, with the revenue loss reaching between $14.5 billion

and $18.4 billion in 1999.

Which leaves room for such easy scoring on Clinton that I won't bother, given that it appears to be the overt and formal policy of the present administration rather than just the typical bow-legged back-room politicking one expects from the basket-weavers in the DLC. This kind of behavior is akin to hiring people in America to work for $2 a day.

:: posted by buermann @ 2003-10-27 11:05:47 CST |

link

|

|

|

|